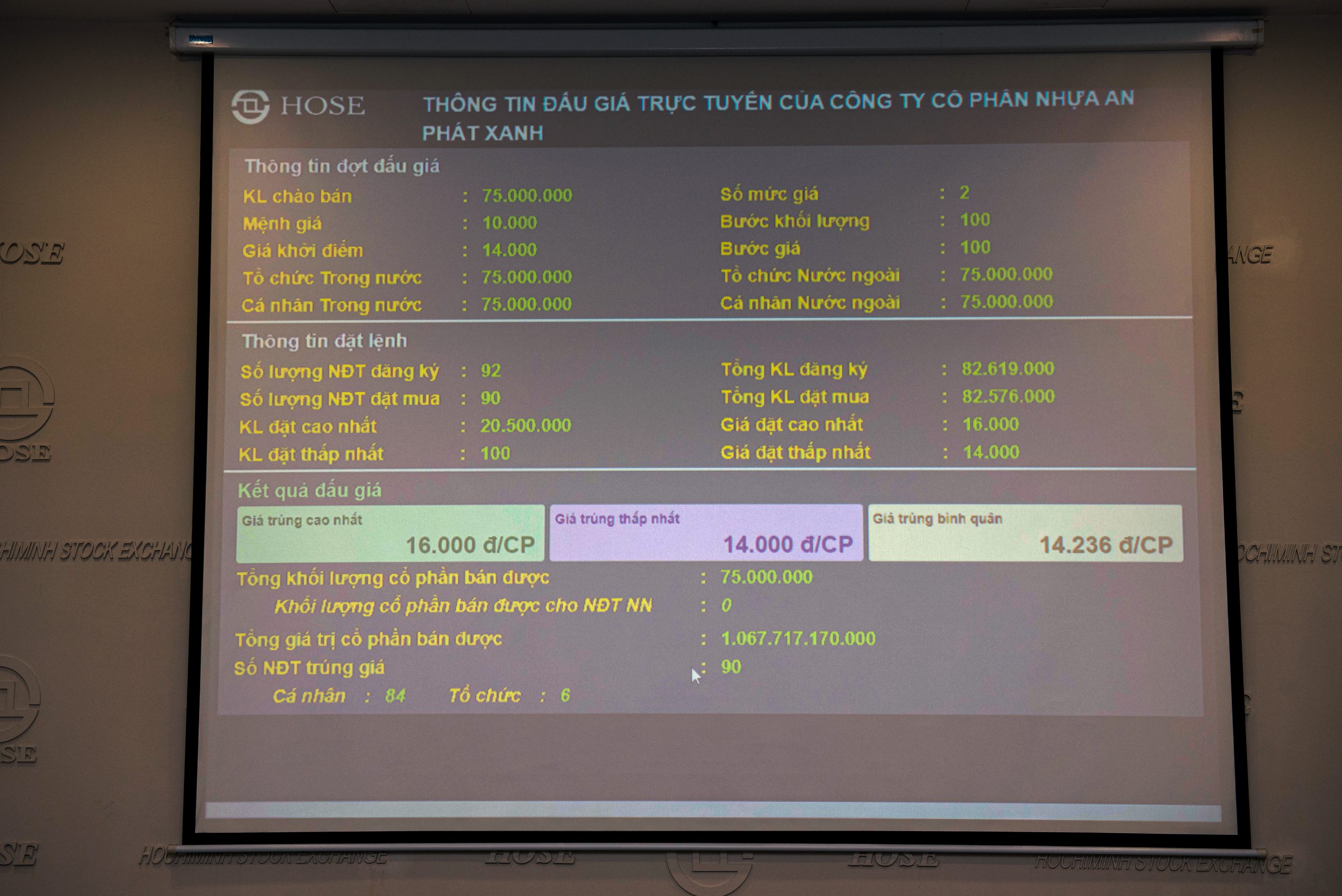

On May 4, 2021, An Phat Bioplastics Joint Stock Company (Ticker: AAA) has successfully carried out an auction to sell 75 million shares at the Ho Chi Minh City Stock Exchange (HOSE), raised nearly VND 1,068 billion (~$ 45.5 million).

Before the auction, 92 investors registered to auction AAA shares, the total number of registered shares up to 82.6 million shares, 10% higher than the offering volume.

With the highest bid price of VND 16,000 per share, the average winning price was VND 14,236, per share; the entire amount raised from 75 million shares will be used for business development, restructuring debt, and production expansion.

AAA auctioned 75 million shares on Ho Chi Minh City Stock Exchange

In 2021, AAA set a target revenue of VND 9,500 billion (~$ 404 million), increases 28%, profit after tax of VND 550 billion (~$ 23 million), increases 94% compared to the previous year, and dividend payout ratio of 15% per value. The highest profit growth plan in the history of AAA is based on the expectation of positive contributions from 3 segments: Industrial real estate, compostable products, and industrial packaging.

In the Industrial Real Estate segment: After An Phat Complex Industrial Park has been operating stably with a rental rate of 90%, AAA continues to invest in building An Phat 1 Industrial Park with an area of 180ha (phase I). In which, revenue from industrial real estate is forecasted to increase sharply from VND 72 billion (~$ 3 million) in 2020 to VND 900 billion (~$ 38 million) in 2021 thanks to revenue from exploiting the remaining area of An Phat Complex IP and An Phat 1 IP is expected to start commercial exploitation from the third quarter of 2021.

In the context of shortage of bank land and the wave of shifting production to Vietnam, the operation and commercial exploitation of An Phat 1 Industrial Park will be an advantage for AAA. It is estimated that, in the next 5 years, An Phat 1 Industrial Park will contribute VND 2,560 billion (~$ 108 million) in revenue and VND 795 billion (~$ 33.8 million) in profit to AAA.

In the compostable products segment: Green products are expected to contribute positively to AAA’s profit growth when the gross profit margin of eco-friendly products is 4-6% higher than that of traditional packaging. Currently, AAA’s compostable packaging production is also taking advantage of existing packaging production lines, so it can be flexibly converted without additional new investment costs.

Regarding business results for the first quarter of 2021, AAA’s revenue and export volume of green products recorded a double growth of the same period last year. In the long term, when the PBAT manufacturing plant invested by An Phat Holdings is put into operation, AAA will have the initiative in green materials, saving production costs about 20- 30%, thereby increasing competitiveness to expand market.

With great market potential, along with many countries have policies to promote production growth, green product consumption, AAA’s shifting to production of green products is the long-term growth drivers for AAA in the coming years. Green products are expected to contribute 40-50% to AAA’s packaging revenue in the next 5 years.

In the industrial packaging segment: AAA’s positive profit growth plan is also based on additional contribution from the jumbo packaging segment of An Vinh Packaging JSC.

After the acquisition of An Vinh Packaging, AAA began to have revenue from trading jumbo packaging used in industrial transportation. An Vinh Packaging’s factory has a designed capacity of 12,000 tons per year and is currently operating at 60-70% capacity. It is expected that the plant will operate at full capacity in 2021.

An Vinh Packaging is expected to contribute VND 500-600 billion (~$ 21 million) per year while profit margin of jumbo packaging is higher than thin monolayer film when running at full capacity.

AAA mobilises nearly VND 1,068 billion (~$ 45.5) from auction of 75 million shares

The successful auction of 75 million shares that raised nearly VND 1,068 billion (~$ 45.5 million) will help AAA have additional capital, structure debt to develop new projects. As business result for the first quarter of 2021, despite the impact of the Covid-19 pandemic in Hai Duong, AAA recorded revenue of VND 2,284 billion (~$ 97 million), an increase of 45% compared to the same period last year. Profit after tax in the first quarter of 2021 reached VND 90 billion (~$ 3.8 million), an increase of 43% compared to the same period last year, completing 24% and 16% of the revenue and profit plan for 2021 respectively.