(Vietnamfinance.vn) An Phat Holdings (APH) successfully auctioned 4,3 million shares, equivalent to 3% of its stake, raised VND 215,08 billion.

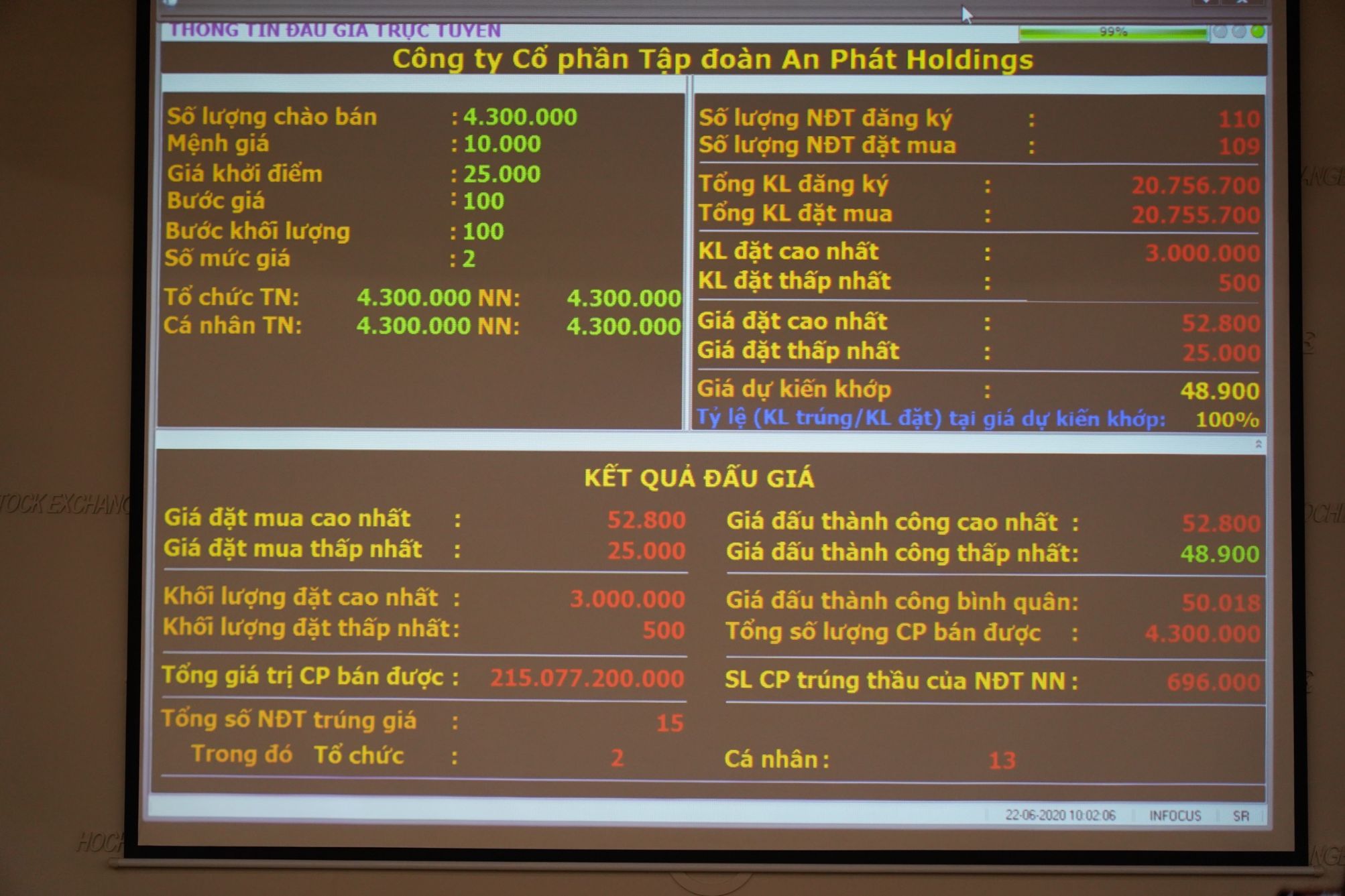

This morning, APH successfully auctioned 4.3 million shares at Ho Chi Minh City Stock Exchange (HoSE). With an average successful bid price of VND 50,018, twice as much as the starting price of VND 25,000 per share, APH is valued at more than VND 6,600 billion.

Earlier, after the Ho Chi Minh City Stock Exchange (HoSE) announced APH’s registration to participate in the auction, the total number of registered shares was 4.8 times higher as much as the selling volume.

As a result, 109 investors participated in the auction, 15 winning investors bought all 4.3 million shares with the highest bid price of VND 52,800 per share.

It is known that all proceeds from this auction will be used to invest in the construction of the compostable material manufacturing plant. The project will help the company have the raw materials self-supply, thereby reducing product costs, expanding market, and approaching potential partners…

Talking about the Initial Public Offering of APH, the Chairman of APH shared: “Despite difficulties in the global market, our sector has not been affected much. On the contrary, APH’s products have received more orders from partners in America and Europe. Henceforth, we place our confidence in this project to build the compostable material manufacturing plant.”

The construction of the plant is expected to start at the beginning of 2021 at Hai Phong, with an 18-month construction period, completed by 2022, with a capacity of 20.000 tons per year and an investment amount of nearly VND 1.500 billion. It is estimated that after going into operation, the factory will bring in revenue of about VND 1,560 billion and profit after tax of VND 376.6 billion in 2025.

With a project scale of more than 70 million USD, APH plans to call for 50% capital from owners’ equity and 50% from borrowed capital. Therefore, in 2020, APH will issue 20 million shares (15.75 million shares to strategic investors and 4.3 million shares for the initial public offering) in order to have enough financial resources for the construction of the compostable material manufacturing plant.

Attending IPO event, Mr. Pham Do Huy Cuong, Standing Deputy General Director & CFO of An Phat Holdings gave a piece of his mind: “With the right business strategies as well as business expansion in other potential sectors, especially with the construction plan of AnBio compostable material manufacturing plant, we hold a strong belief that in the next 5 years, An Phat Holdings will become the biggest bioplastics group in South East Asia.”

APH is the parent company that owns 55% stake of Hanoi Plastics (Ticker: NHH), 48% of An Phat Bioplastics (Ticker: AAA), An Tien Industries (Ticker: HII) and the other subsidiaries. HII contribute 86% and 80% of revenue and gross profit respectively to APH in the first quarter of 2020, while the remaining 14% and 20% respectively came from NHH. In 2019, APH’s consolidated revenue and profit after tax is VND 9,513 billion and VND 712 billion respectively, increased 19% and 305% over the same period in 2018.

Moreover, after just more than 1 year in operation, the industrial real estate segment achieved enormous success by contributing 7% of revenue and 29% of gross profit in 2019 while the supporting industry segment now comprises about 12% of APH’s consolidated revenue with an average growth of 9% each year in the period of 2015 – 2019. In 2020, APH set a target for revenue and net profit up to VND 12,000 billion and VND 650 billion respectively.