- 4,3 million shares of An Phat Holdings (Ticker: APH) were successfully auctioned on its IPO, raising VND 215,08 billion

- Total of VND 215,08 billion raised from 4,3 million shares will be used to invest in building AnBio compostable material manufacturing plant.

Ho Chi Minh, June 22nd, 2020 – Today, An Phat Holdings (Ticker: APH) is pleased to announce the success of its Initial Public Offering, with 4,3 million shares purchased on the Ho Chi Minh Stock Exchange (HoSE), raising VND 215,08 billion.

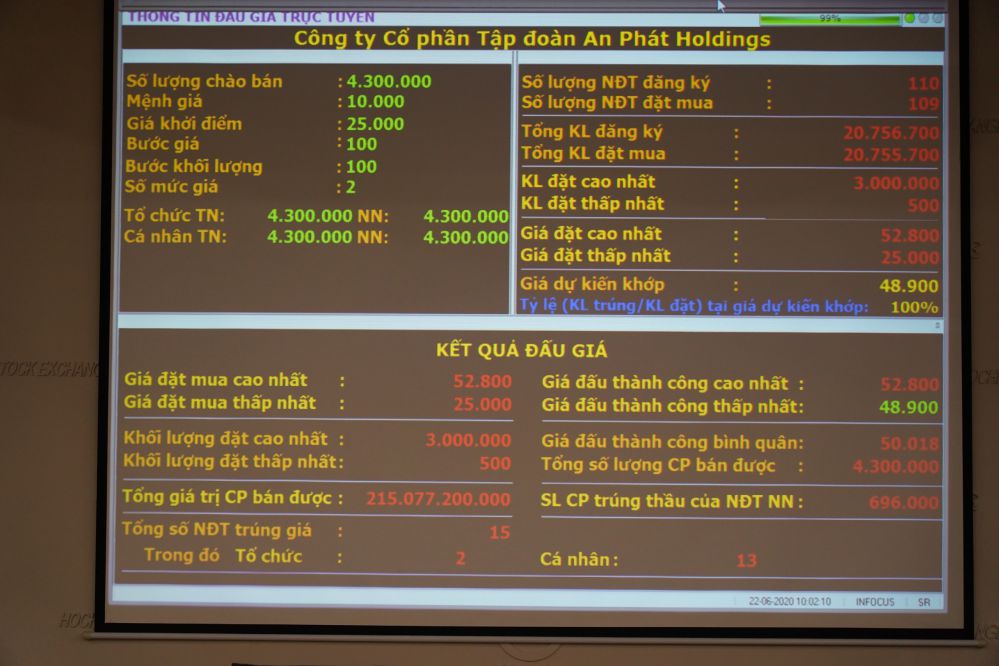

With a starting price of VND25,000 per share, there were 109 investors participating in An Phat Holdings’ IPO, the total number of registered shares up to nearly 20,8 million shares. The highest bid price was VND 52.800 per share.

As a result, An Phat Holdings sold all 4.3 million shares to 15 investors at the average price VND 50.018 per share, twice higher than the starting price of VND 25.000. The total raised amount is VND 215,08 billion correspondingly.

With this successful result, APH is expected to be valued at over VND 6,600 billion.

A total of VND 215.08 billion raised will be used to invest in building AnBio compostable material manufacturing plant. The construction of the plant is expected to start at the beginning of 2021 at Hai Phong, with an 18-month construction period, completed by 2022, with a capacity of 20.000 tons per year and an investment amount of nearly VND 1.500 billion.

Thanks to the initiative in material resources, it is expected that in the next 3-5 years, the profit from compostable bags can increase from 10% currently to about 50% in APH’s packaging revenue. Therefore, it can significantly improve An Phat Holdings’ profit margin, as the gross margin of this product line is about 20% compared to the average 14% of conventional packaging.

The total capital needed for AnBio compostable material manufacturing plant is over USD70 million, An Phat Holdings plans to call for 50% capital from owners’ equity and 50% from borrowed capital. In 2020, the company seeks to raise about 80% of the needed capital while the remaining 20% will be raised next year mainly from commercial loans or straight bonds.

Thus, An Phat Holdings formulate a plan to issue 20 million shares in 2020, equivalent to 14% of the outstanding shares. Accordingly, the proportion of new shares is 15.75 million shares for strategic investors and 4.3 million shares for the initial public offering. At present, An Phat Holdings is discussing with foreign investors about development cooperation strategies.

About An Phat Holdings

Founded in March 2017, An Phat Holdings’ main business areas include Packaging; Compostable products & compounds; Engineering plastics & building materials plastics; Raw materials and chemicals for plastics industry; Precision engineering & molding; Industrial real estate. Since its establishment, An Phat Holdings has continuously increased its charter capital to VND 1,423 billion and becoming a public company since January 2020.

Also, APH is the parent company that owns 55% stake of Hanoi Plastics (Ticker: NHH), 48% of An Phat Bioplastics (Ticker: AAA), An Tien Industries (Ticker: HII) and the other subsidiaries. HII contribute 86% and 80% of revenue and gross profit respectively to APH in the first quarter of 2020, while the remaining 14% and 20% respectively came from NHH.

In 2019, APH’s consolidated revenue and profit after tax is VND 9,513 billion and VND 712 billion respectively, increased 19% and 305% over the same period in 2018. In the past, APH’s revenue mainly came from the packaging segment (90% of revenue and profit), but now the enterprise has expanded its business portfolios. The supporting industry segment now comprises about 12% of APH’s consolidated revenue with an average growth of 9% each year in the period of 2015 – 2019.

Furthermore, after just more than 1 year in operation, the industrial real estate segment achieved enormous success by contributing 7% of revenue and 29% of gross profit in 2019. Meanwhile, the compostable product and compound segment keep generating huge profit.

In 2020, APH set a target for revenue and net profit up to VND 12,000 billion and VND 650 billion respectively. In the long term, APH’s growth driving force will come from compostable products thanks to its manufacturing factory with an expected capacity of 20.000 tons per year.

“That An Phat Holdings’ IPO on HoSE will improve its access to capital, raising capital, strengthening its capabilities to achieve long-term targets. With the right business strategies as well as business expansion in other potential sectors, especially with the construction plan of AnBio compostable material manufacturing plant, we hold a strong belief that in the next 5 years, An Phat Holdings will become the biggest bioplastics group in South East Asia,” said Mr Pham Do Huy Cuong – Standing Deputy General Director & CFO of An Phat Holdings.

After this successful IPO launching, An Phat Holdings will have a Roadshow at the beginning of July 2020 before officially being listed on HoSE at the end of that month.

***Contact:

PR DEPARTMENT – AN PHAT HOLDINGS

PR Executive: Tran Thu Ha

Email: hatt1@anphatholdings.com Mobile: 09066.55506

Thanks and Best regards.