Securities companies recommend buying DGW because of new drivers of growth from office equipment and Xiaomi; buying AAA because the price is still “cheap” compared to other plastic enterprises in the same position and increases the proportion of PVT when business results grow as expected.

Buy DGW with a target price of VND 29,966/ share

According to Phu Hung Securities JSC (PHS), Digital World JSC (HOSE: DWG) recorded impressive business results in the third quarter of 2019 with net sales of VND 2,615 billion, up 51% over the same period last year; profit after tax of the holding company was VND 52 billion, up by 42% compared to the same period.

In general, the growth came from all categories, but the highest revenue contribution was still mobile phones, with a strong increase concentrated in the mid-range segment, especially the Xiaomi brand. In the first 9 months of 2019, DGW reached VND 5,992 billion, fulfilling 84% of the plan. With an average growth rate of 40% in each quarter, DGW’s estimated profit after tax in the fourth quarter of 2019 would reach VND 45 billion.

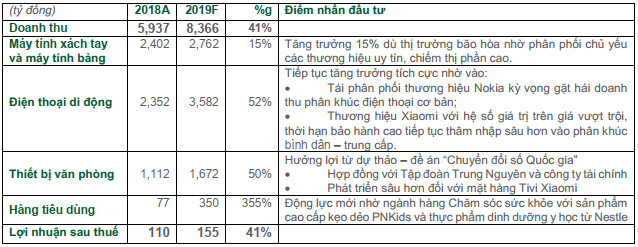

PHS offers investment highlights for DGW’s businesses Unit: VND billion

Source: PHS |

In mobile phone segment: DGW recovered thanks to increasing market share of Xiaomi mobile phone consumption in Vietnam from less than 2% to over 5% and smartphone segment from signing a new contract with Nokia by the end of 2018, raising the proportion of mobile phones to more than 40% of the revenue structure.

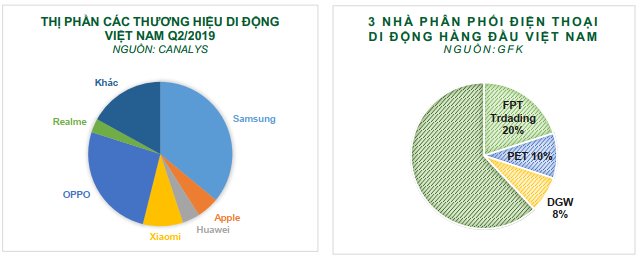

PHS cited statistics from Canalys, in the second quarter of 2019, Samsung accounted for 36% and Apple accounted for 5% of smartphone market share in Vietnamese market. Although these are two well-known brands with high market share in Vietnam, Samsung and Apple still have to “wary” with a series of brands from China such as OPPO, Xiaomi or Huawei. Before being affected by the ban of the US government, Huawei had a strong growth momentum in Vietnam, especially in the high-end segment when launching flagship models competing directly with Apple and Samsung.

Pie piece of market share of DGW

|

Office equipment segment: Digiworld has determined that the company’s driving force is the office equipment. This is benefiting from the digital transformation trend in 2019. The strategic cooperation between Digiworld and Seagate in mid-September of 2019 is a proof to the realization of Digiworld’s long-term growth plan.

In addition, to keep up with the trend of digital transformation, in May 2019, DGW officially cooperated with HTC VIVE to distribute products in the field of Virtual Reality. HTC VIVE will create an ecosystem for hardware and software, thereby providing an opportunity to increase revenue from auxiliary products for DGW. DGW will work with HTC to develop ecology, offer a total solution, specifically providing hardware solutions in the areas of marketing, sales, warranty.

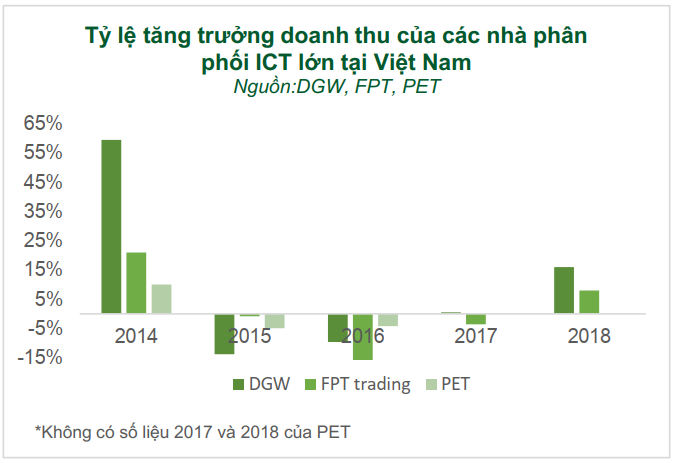

According to PHS, DGW also strives to maintain its leading position in the field of ICT distribution.

|

Source: PHS Research |

Specifically, DGW not only provides a simple distribution service but also has the advantage of owning a specialized Market Expansion Service (MES), including providing (1) market analysis services, (2) marketing, (3) importing and warehousing, (4) sales and distribution, (5) after-sales service. In addition, DGW continues to strive to improve its competitive position in the distribution sector in general and maintain its leading position in the ICT distribution sector in particular by investing in ERP software systems.

Thanks to ERP, DGW increases the capabilities of financial management and logistics while bringing transparency to the financial reports of enterprises. This is a “plus” of DGW for investors and banks in the process of considering investment opportunities or lending. Besides, creating a competitive advantage helps DGW receive great attention from major manufacturers and well-known brands in need of goods distribution.

Regarding healthcare: DGW expects this segment will continue to grow in 2019 thanks to the signing of a strategic cooperation with Nestle Vietnam in January 2019.

Based on the optimistic growth prospects, PHS recommends buying DGW stock at the target price of VND 29,966/ share.

Buy AAA with a target price of VND 31,000/ share

According to Stanley Brothers Securities JSC (SBSI), An Phat Bioplastics JSC (HOSE: AAA) had strong business results growth over the same period. At the same time, the Company has many prospects for growth.

AAA’s consolidated revenue and profit before tax in the third quarter of 2019 increased by 8% and 49% over the same period to VND 2,364 billion and VND 86 billion. Core production grew strongly by 47% in revenue and 10.2% in profit.

In particular, about the market: AAA promoted the market development to the US and Japan. Recent meetings with the Governor and Nebraska State Mission of the United States, the Governor and the Delegation of Kagoshima province of Japan have made clear the strategy of AAA’s market expansion.

Regarding products: Promoting self-decomposed products and increasing the efficiency of factories help the company improve profit margins. AAA’s 100% compostable products now contribute to 10% of export sales.

In the first 9 months of 2019, AAA’s profit doubled the whole year of 2018 due to the contribution of the industrial zone segment in the first 3 quarters of 2019 and the strong growth of manufacturing in the third quarter. Compared to the business plan for the whole year of 2019, AAA has now fulfilled 74% of revenue plan and 85% of profit after tax plan.

Regarding growth prospects, SBSI believes that in the short term, plastic resin trade will help AAA improve its profit margin. AAA is currently one of the largest plastic resin importers in Vietnam. With a large market share of plastic resins, combined with the advantages of a product off-take agreement of Binh Son refinery, SBSI expects commercial revenue of over VND 3,600 billion/ year and profit after tax of VND 50 billion/ year.

In the long term, AAA is one of the few enterprises capable of producing self-decomposed products and keeping up with the trend of moving from conventional bags to self-decomposed products. At the same time, the PBAT project of APH will help AAA cut about 30% of raw material costs.

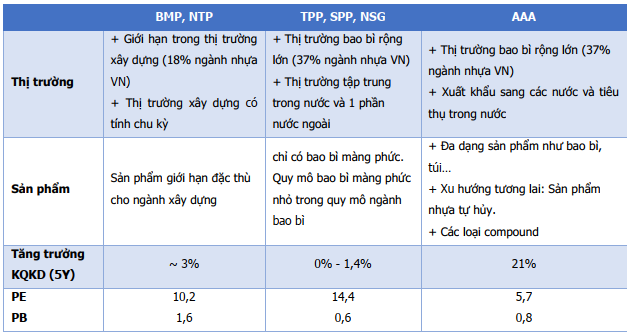

Table to compare among AAA and other enterprises in plastic

|

Source: SBSI Research |

Increase the proportion of PVT with the target price of VND 20,000/ share

According to Agribank Securities JSC (Agriseco), Petro Vietnam Transportation Corporation (HOSE: PVT) will maintain a positive trend in the last quarter of 2019.

According to data from PVT, in the third quarter of 2019, PVT reached about VND 167 billion, up 43% over the same period. In the first 9 months, revenue reached VND 5,825 billion, exceeding the plan; profit before tax was VND 585 billion, 16% higher than the same period, gross profit margin continuously improved.

This is a positive result following with Agriseco’s judgment, expected to remain positive in the last quarter of the year, especially when Nghi Son petrochemical refinery is increasingly improving operating efficiency, adding more workload to PVT.

The core business is transportation services which still account for a high proportion in revenue structure, more than 65%. At the same time, this is also the main fulcrum for growth in the third quarter when revenue increased by 21% and gross margin improved from 13% to 16%.

PVT continually liquidates assets and purchases new assets, demonstrating the process of replacing young fleets to improve its operating capacity. This plan has been emphasized by PVT since the beginning of the year and initially showed the efficiency when the gross margin was improved due to the improved operating efficiency from the new fleet. PVT still pursues the ambition to buy a large specialized ship for importing crude oil from the Middle East after signing a long-term contract with Nghi Son Petrochemical Refinery by the end of this year.

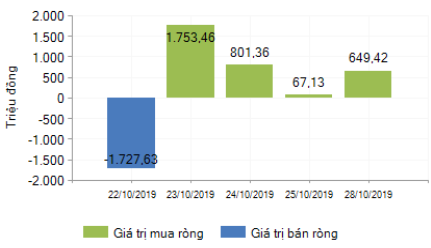

Foreigners returned to be net buyers of PVT shares

Quoted recommendation in purchasing stocks of securities companies are valuable as a source of information for investment decisions of investers. These recommendations may have conflicts of interest with investors.

Source: Vietstock